When Italians were thinking about good intentions and proposals for the New Year, a new unexpected virus, highly contagious and completely unknown to our immune system, started circulating in certain parts of the world. This virus is called Coronavirus. We would never have thought at the time that this virus, apparently so far away, could have spread and caused many problems at individual and collective level, for health and economic systems also in Italy. So, just over two months the global scenario radically changed and we have had to adapt to the new reality in the virus emergency, also called COVID-19 emergency.

When Italians were thinking about good intentions and proposals for the New Year, a new unexpected virus, highly contagious and completely unknown to our immune system, started circulating in certain parts of the world. This virus is called Coronavirus. We would never have thought at the time that this virus, apparently so far away, could have spread and caused many problems at individual and collective level, for health and economic systems also in Italy. So, just over two months the global scenario radically changed and we have had to adapt to the new reality in the virus emergency, also called COVID-19 emergency.

Coronavirus outbreak has been labelled a pandemic by the World Health Organization (WHO). A pandemic is a disease that is spreading in many countries around the world at the same time. Italy rapidly became one of the most affected countries in the world. The infection, first limited to in Northern Italy, spread to almost all other regions.

Therefore, the Italian Government, after the first precautionary measures, adopted immediately starting from January 2020, proclaimed the state of emergency and started to implement measures to effectively fight against the epidemic. With the aim to combat such a virus, the Italian Government issued several decree-laws providing measures to tackle the crisis from a health and economic point of view.

Measures issued by the Government have been gradually applied on the basis of the emergency status.

In “Phase 1” a strong lockdown has been imposed to people requiring them to “stay home”; municipalities borders, schools, universities, public and private offices have been closed in order to fight against Coronavirus. The gradual easing of Italy's lockdown started on 4th May 2020 with the reopening of manufacturing and other activities.

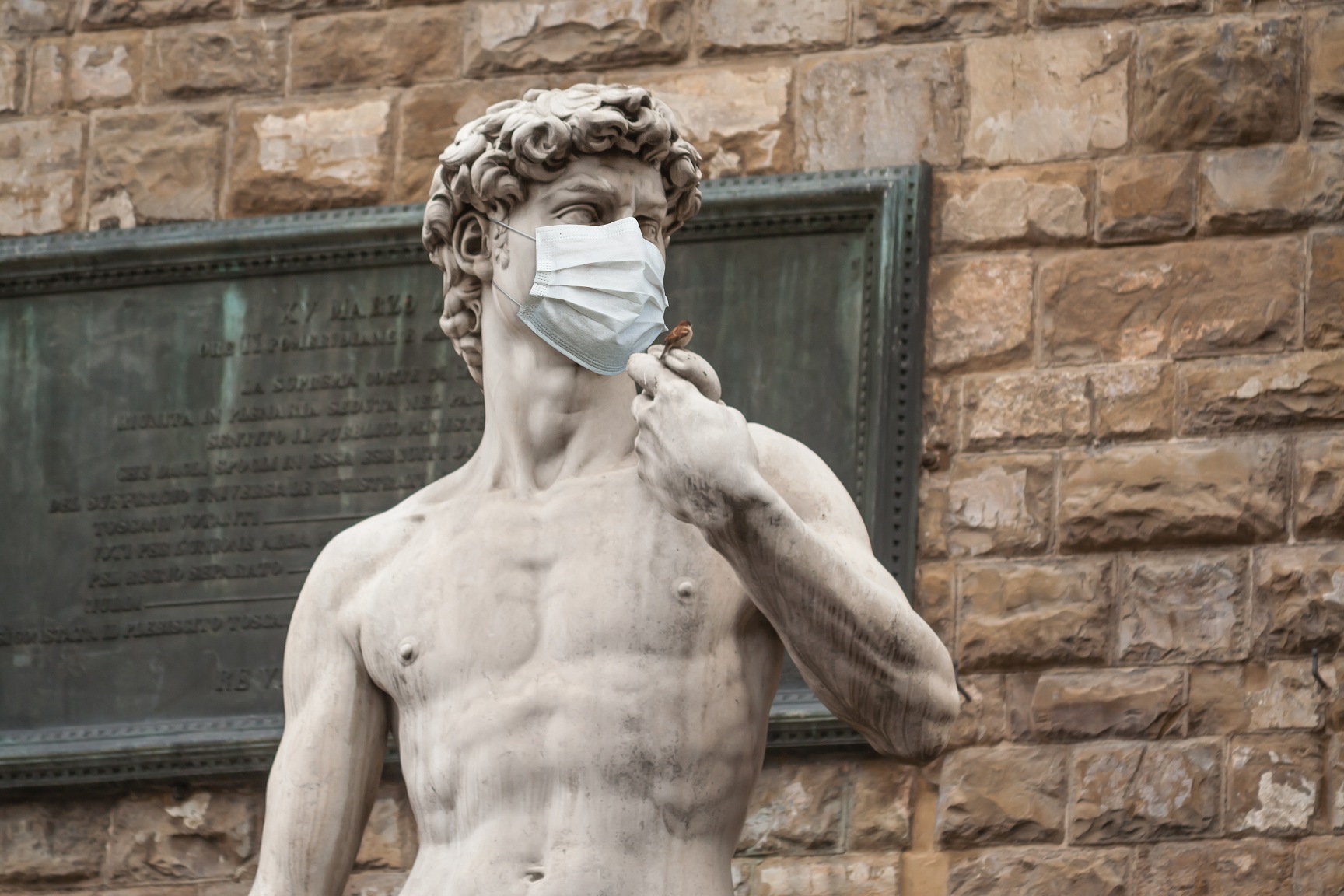

This led to a “Phase 2” softer lockdown, and the issuing of the “Relaunch” law decree. Nevertheless, the softer lockdown of “Phase 2” keeps, anyway, high prevention and protection criteria for people and workers, like putting face masks and respecting 1-meter distance among people.

After the 3rd June, most businesses have reopened, like manufacturing and construction sectors, bars, hairdressers and barber shops, retail activities (apart from shops already authorised, like those selling food, personal hygiene products, pharmacies and tobacconists) like clothing stores, book stores and others, public transport. Borders among regions were also reopened.

Furthermore, the Government has temporarily accepted immigrants working in farm and houses, allowing them to access health care and other services as legal residents of Italy. One of the first decrees is Decree-Law No 18 of 17th March 2020, so-called “Cure Italy”, followed by various other laws, like Decree-Law No 33 of the 16th May 2020, so-called “Relaunch”. Such measures show the state of play of the outbreak: “Cure Italy” Decree-Law is facing with “Phase One” providing several strict measures against COVID-19, for instance, the lockdown and the quarantine, and “Relaunch” Decree-Law is facing with “Phase Two” providing mainly economic and financial measures and mitigating the stringent measures containing in “Cure Italy” decree. Governmental rules provide for a series of measures, among others, to support National Health Care system, Civil Protection Department and other public bodies involved in the emergency, employment and workers to protect their work and income, companies, local authorities, Third Sector, schools and families.

The measures explained below refer to the rules provided by the mentioned laws. The legislation is under a constantly updating process.

Measures to strengthen the National Health Care system and the Civil Protection Department

The Government mobilised all needed resources to ensure staffing and tools for the Health Care System, the Civil Protection Department and law enforcement bodies in order to assist people affected by the disease and prevent, mitigate and contain the epidemic. More specifically, the Government proceeded immediately to hire medicals and nursing personnel to reinforce the units of military health care services and to involve private hospitals. Rules allowed, if necessary, the requisition of private facilities and properties in order to enhance medical facilities and health care networks across the Country. The Government also streamlined the purchasing procedures for medical protection equipment. This allowed, among others, the timely acquisition of assisted ventilation equipment and protective face masks.

Measures to preserve employment levels and income

Preserving jobs and incomes is crucial to shield families and businesses from the economic consequences of the Coronavirus pandemic. To this end, the Government adopted the main following measures:

- Allowance to strengthen the social safety net, in particular temporary unemployment benefits for employees in every productive sector. The monthly allowance falls within a certain range, according to specific criteria;

- Financial allowance for payment of wages (including social security and assistance contributions related to enterprises), also for self-employed workers to avoid dismissals due to pandemic;

- Strengthen the Emergency “Wage Guarantee Fund” to reduce the personnel cost for employers in case of suspension/reduction of the company’s activities due to exceptional circumstances (e.g. health emergency caused by the spreading of the COVID-19);

- Ban on redundancies for a certain period of time;

- Monthly Bonus within a certain range to self-employed workers, workers having collaboration and continuous contracts and workers in the tourism sectors. Bonus is provided for a few months, according to specific criteria;

- Monthly Bonus of a certain amount in favour of entertainment workers, provided for a few months, according to specific criteria.

Measures to help enterprises

The Italian Government is supporting businesses suffering from a collapse of revenues and a sudden lack of liquidity also caused by the credit crunch. The main measures adopted are:

- Financial assistance to small and medium enterprises whose turnover is below a certain threshold. The enterprise will receive a certain amount on the basis of its size and the number of its losses in the previous months;

- For larger companies, the law provides that the State could participate in the company’s equity, following the enterprise request to Deposits and Loans Fund (“Cassa Depositi e Prestiti”);

- Easier access to bank loans with Governmental guarantee;

- Bonuses in favour of enterprises working in the constructions and tourism sectors.

- Emergency fund to support cultural entities such as libraries, publishers, museums, cultural centres to alleviate the losses resulting from the cancellation of shows, concerts, fairs, congresses, and exhibitions;

- Outright grants to enterprises and self-employed workers meeting specific turnover criteria. The grant amount varies according to the income range;

- Tax credit up to a certain amount for rental expenses paid by small-medium companies whose turnover rests under a certain threshold. However, this tax credit is provided regardless of turnover in relation to hotels;

- Tax credit to sustain investment costs for the safe reopening of economic activities for the health of the workers;

- Discount on electric bills for a defined period of time;

- Suspension of payments for businesses and professionals meeting certain turnover criteria. Withholding taxes, VAT, social security contributions, National Institute for insurance against industrial injuries (“INAIL) contributions, tax assessments and other control notices, tax bills are suspended for a certain period of time;

- Employed and self-employed workers can request the suspension of loan instalments related to their “first home”, under specific conditions, for a defined period of time. Instalment suspension has to be directly requested to the financial intermediary providing the mortgage.

Measures to help local and regional authorities

The Italian Government supports local and regional authorities by various measures:

- Allocation of a certain amount to be shared between municipalities, provinces and metropolitan cities, based on the loss of revenue and the needs for the fundamental functions;

- Providing the opportunity for local authorities to renegotiate mortgages and other loan modalities;

- Granting advances to regions and local authorities in order to pay their commercial debts, in case of lack of liquidity, also deriving from COVID-19 epidemic.

Measures to support the Third Sector

The Italian Government implemented some measures to help the no-profit sector, in terms of:

- Tax credit to cover the costs of sanitising properties and suspension of the rent for a period of time;

- Resources allocation for individual security devices.

Measures to protect security at school

The Italian Government suddenly ordered the closure of all schools and universities nationwide for a certain period of time. Lessons, training and exams are performed online. With the aim to support the safety and protection of schools and educational institutions, funds have been allocated in order to intervene before their reopening. Professional services for the workplace safety, education services for medical, health and psychological assistance, purchase of protection and hygiene material and laundry services are some of the measures applied.

Measures to help families

Last, but not least, several measures were adopted to help families mainly from an economic point of view. The following measures were taken:

- Bonus for families employing domestic workers, care attendants and babysitter based on defined rules;

- Extra parental leaves to take care of the family;

- Tax credit for holidays in favour of families whose income is below a defined threshold;

- Bonus to purchase bicycles and other means of transport such as monowheel and also for using shared mobility services;

- Refunds under a certain threshold for public transport, such as bus, metro and train;

- Funds to strengthen summer camps for children;

- Tax deductions and tax credits concerning eco and anti-seismic measures, in terms of deductions for energy redevelopment and anti-seismic measures costs, installation of photovoltaic systems and building restructuring works.

In the framework of the governmental rules to fight against COVID-19, the Italian Revenue Agency adopted several measures. First of all, the Italian Revenue Agency regulated the physical presence of the employees in the offices. Generally speaking, presence of staff in the premises need to comply with health measures, in terms of safety distances (at least 1-meter distance), using face masks, frequently disinfecting hands and other minor recommendations. From the tax administration side, the main recommendations concern the health protection to keep the working environment as clean, disinfected and sanitised as possible. With reference to work, most activities are carried out digitally and some others necessarily require manual and paper processing. Activities that can be remotely processed are, for instance: support activities to the Ministry of Economy and Finance in urgent law-making procedures, litigation, tax assessments and recovery, release of the Tax Identification Number (TIN), tax refunds, relations with International Organisations, and many others.

Protecting staff health

The Italian Revenue Agency has adopted a wide range of prevention and protection measures to ensure employees’ safety at the workplace such as general measures to protect workers' health; measures to reduce physical access by customers to offices. All these measures are contained in the Risk Assessment Document that is subject to continuous update, in close coordination with the Prevention and Protection Services. As for information on general risks regarding health and safety, information on risks is usually delivered via emails and identifies the general and specific risks connected with specific working activities. Managers are required to protect the health and safety of their employees even when they are working remotely. To this end, employers are required to deliver information on risks regarding health and safety at work to employees working remotely.

Smart Working

In accordance with the law, during the health emergency “Smart Working” is considered as the ordinary method to perform the working activity. Among others, Smart Working aims at promoting sustainability mobility by improving home/work journeys and reducing the permanence of staff inside the Office. Italian Revenue Agency staff in remote working use remote access and videoconference tools for participating in business meetings. The work performed by the employees can be assessed by using IT tools in relation to activities planning and outcomes measuring. IT devices (i.e. personal computer, tablet, smartphone) provided by the employee need to be checked and tested by the Central Information Department of IRA, in order to confirm their suitability, according to specific requirements. Nevertheless, IT equipment can be provided by the tax administration.

A special section, dedicated to COVID-19, is available on the Agency's intranet portal with the regulatory provisions adopted to deal with the current emergency, directives, internal circulars, adopted measures and intervention procedures, information material by the Ministry of Health and Civil Protection (e.g. updated map on the epidemiological situation) and FAQs. The regulatory provisions and directives of the Agency are also forwarded to employees via email, especially those concerning remote working regulation. The Covid-19 special units (at central and at a regional level) are constantly in contact with the Human Resources and with the Media department. On the Italian Revenue Agency website https://www.agenziaentrate.gov.it/portale/ a special section, dedicated to COVID-19 was set up to inform taxpayers of the emergency. The communication strategy has used press releases, news on the institutional website and on Revenue Agency’s official accounts on Facebook, Twitter and LinkedIn. The Agency has also published a vademecum on the COVID-19 Emergency Tax Measures.

Simplified tax controls and services to taxpayers

The Italian Revenue Agency implemented several measures to simplify tax controls and services to taxpayers in the coronavirus emergency. With reference to tax control activity, IRA applied some measures to make the administrative process as simple as possible and to support taxpayers in meeting their fiscal obligations. In particular, several relevant measures have been implemented:

- Extension of deadlines for tax payments and tax filing remitting penalties and interest;

- Coercive tax collection suspended;

- Audits and assessment activities postponed (except in case of fraud).

With reference to financial services the following measures have been applied:

- The Revenue Agency information tools to assist taxpayers are manifold: Internet portal, mobile app, contact centre and e-mail boxes. In particular, many of the services are provided at the counter but also directly on the website, without requiring any registration (for example, filling in and printing the payment forms, calculation of the car stamp, correction of the cadastral data of the buildings and so on);

- Issue of Tax Identification Number upon request by the taxpayer. The request can be sent via e-mail or PEC (certified e-mail address). In the same way, the certificate will also be sent to the taxpayer. Online services can be used to request for a duplicate TIN and/or health card;

- Act registration documentation can also be sent via PEC or e-mail;

- Requests for direct taxes and/or Value Added Tax (VAT) and/or other indirect taxes refunds can be sent via PEC or e-mail;

- Several chances are provided for the online pre-filled tax return by Public System of Digital Identity (SPID) that allow accessing the Public Administration services, by FISCOONLINE system that is managed by the Italian Revenue Agency, by INPS website and by the National Service Card (CNS).

Apart from the measures adopted by the Italian Government and the Revenue Agency, an important action to fight against Coronavirus is also based on virtuous person behaviour.

To conclude, Italy is doing its best, hoping that the virus will turn soon into a sad memory. Italy is a country of poets, saints, navigators and also fighters against Coronavirus.

The following links provide further information:

- Italian Government: http://www.governo.it/

- Civil Protection: http://www.protezionecivile.gov.it/

- Ministry of Economic and Finance: www.mef.gov.it

- Italian Revenue Agency: www.agenziaentrate.gov.it

- Ministry of Health: www.salute.gov.it

- Department of Finance: www.finanze.gov.it

- INPS: www.inps.it

- INAIL: https://www.inail.it/cs/internet/comunicazione/avvisi-e-scadenze/avviso-coronavirus-informativa.html

Ilaria Petracca

IOTA PCP for Italy