Among the adopted strategic development plans of the national tax system, “The Strategic Plan for the Development of the Tax System for 2013-2020” has been an important milestone. This document features the introduction of an incremental and comprehensive approach to the improvement of various areas of tax system, as well as providing taxpayers with modern and high-quality services.

One of the important aspects of the mentioned Strategic Plan is to learn the international good practices pertaining to “Pre-filled tax returns”. In this regard, Ministry of Taxes applied to Technical Assistance and Information Exchange instrument of the European Commission – TAIEX. The relevant request was approved and “Pre-filled tax returns” experience of Finland Tax Administration was chosen.

One of the important aspects of the mentioned Strategic Plan is to learn the international good practices pertaining to “Pre-filled tax returns”. In this regard, Ministry of Taxes applied to Technical Assistance and Information Exchange instrument of the European Commission – TAIEX. The relevant request was approved and “Pre-filled tax returns” experience of Finland Tax Administration was chosen.

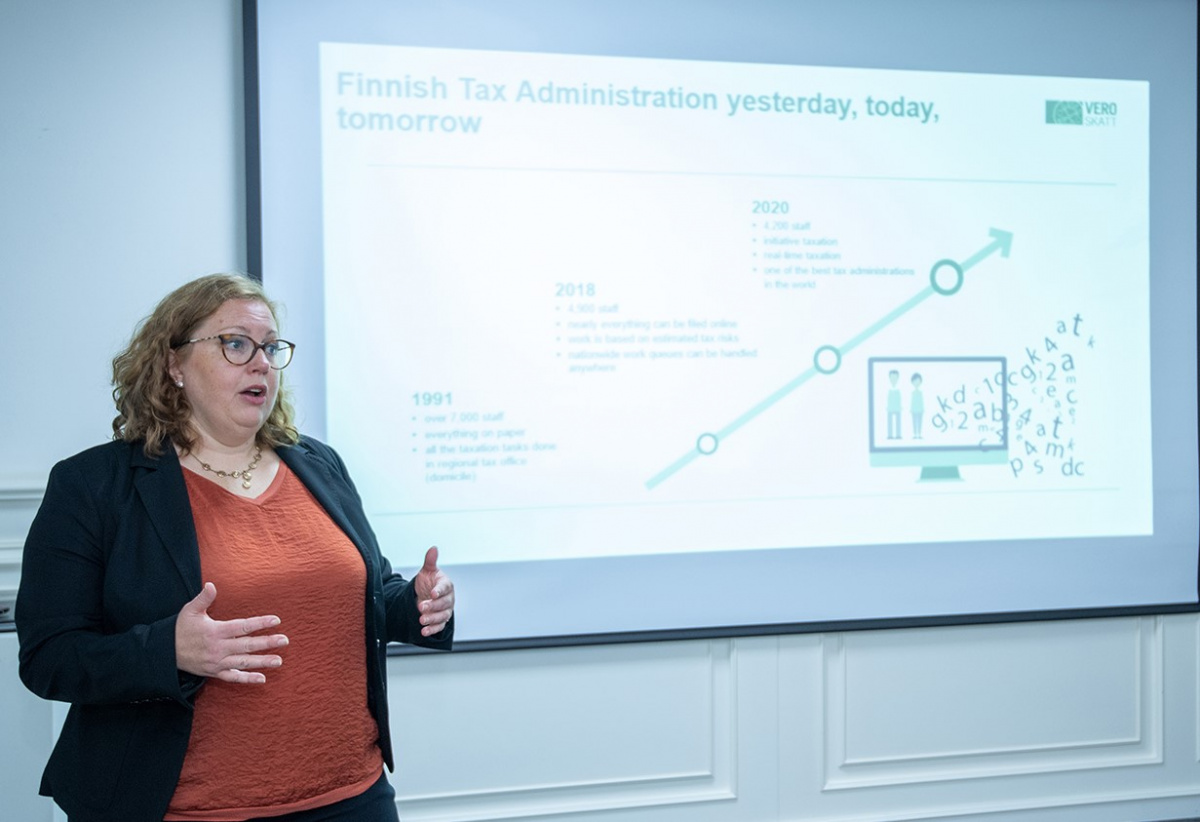

On 30 September – 2 October Ministry of Taxes hosted TAIEX expert mission on “Pre-filled tax returns”. During 3 days workshop Chief advisers from Finland Tax Administration Ms. Heli Annala and Ms. Merja Holanti had delivered presentations and discussed with representatives of the Ministry of Taxes various aspects, such as legal framework of pre-filled tax returns, sources of information, preparation of a declaration and exchange of information.

We would like to express our gratitude to our colleagues from the Tax Administration of Finland for the extended cooperation and support.

We would like to express our gratitude to our colleagues from the Tax Administration of Finland for the extended cooperation and support.